These may help to verify your tax filing status if you are in need of government benefits. Make sure to get a transcript of your tax return. You may find it helpful to keep receipts for educator expenses, dependent care expenses, and other expenses. It is important to keep good records throughout the year so that you can easily prepare your tax forms when it comes time to file. If you have employed a nanny, housekeeper, gardener, or another household employee to help out around your home, make sure that you are paying any required household employment taxes like social security and Medicare.

#Form 1040 ischedule 2 how to

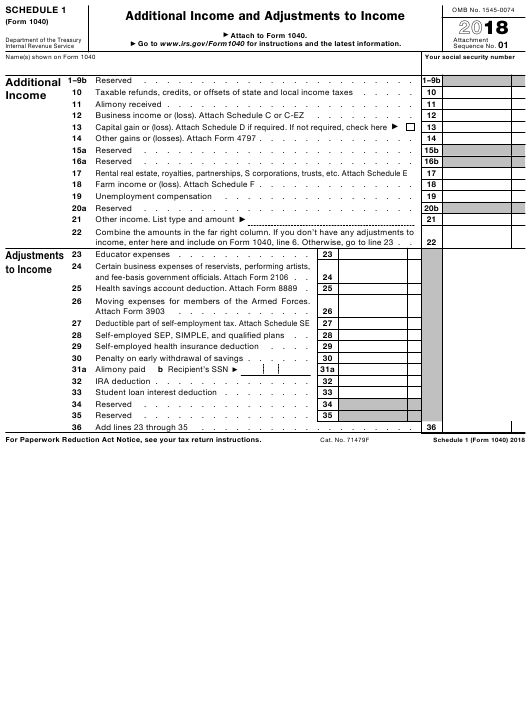

Let’s chat a little bit about how to properly file your 1040 Tax Form. How to File Your 1040 Tax Formįiling tax forms is often tedious and confusing for many people trying to file their taxes. By doing so, they can report their total income and charitable deductions, which helps to ensure that they are complying with tax regulations. Non-profit organizations, including charities, churches, and nonprofit groups, may also be required to file a 1040 Form each year. This helps them to report income earned by the estate or trust, as well as any tax credits or deductions that may apply. Estates and trusts, such as foundations, charities, and family trusts, are required to submit an annual tax return using the 1040 Form. This helps to ensure that all parties are compliant with tax regulations and accurately report their income and deductions. Partnerships, such as LLCs (limited liability companies) and S corporations, typically file a 1040 Form for each of their business partners. This form provides a way for them to report all of their income and tax deductions, and calculate any taxes that are owed. Individuals, including single filers and married couples filing separately, generally use the 1040 Form to file their tax returns each year. Next, we will look at four different taxpayers that may use a 1040 Form. While many taxpayers are familiar with the 1040 form and how to file it, you might be wondering who exactly fills out an IRS 1040 form. Payments may be submitted electronically through the IRS website, or by mail. If you owe taxes for the year, you can use the 1040 Form to schedule your payment. This can help reduce your tax liability and save you money in the long run.

Along with calculating your taxes owed, the 1040 Form also allows you to identify any potential tax credits or deductions you may be eligible for such as medicare tax. To help you determine the taxes you will pay, the IRS Form 1040 includes a detailed schedule that allows you to report all of your income sources, deductions such as a student loan interest deduction, and tax credits.

This form allows you to calculate your total taxable income for the fiscal year. The IRS Form 1040 is the primary form used to file your federal income tax return each year. Have you ever wondered how to file taxes and what the purpose of an IRS 1040 tax form is? Let’s take a look at four things a 1040 form is used for. What is the purpose of an IRS 1040 Tax form?

0 kommentar(er)

0 kommentar(er)